Property Taxes

Taxes on Selling Properties in Thailand

Many individuals who have invested in property in Thailand are often very unaware of the tax liabilities that may arise on selling the property.

Typically, foreigners have invested in property either through buying a condominium unit which they hold in their own name or having taken out a lease on a landed property.

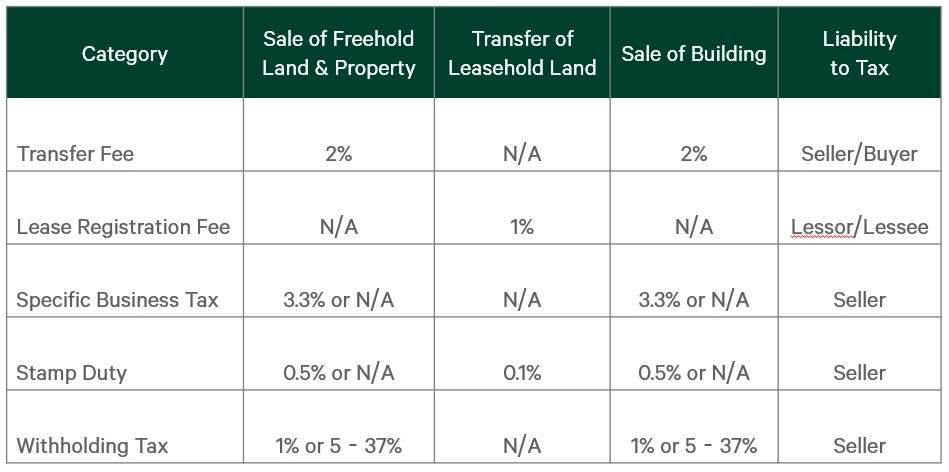

As our analysis shows below, an individual or other legal structure will always be subject to taxation on the sale of the property. The general tax rates (excluding company or individual personal tax which may also apply eventually) are shown below. Perhaps surprisingly, for an individual selling a property, the taxation system is actually very complex.

Note: From now until 31 December 2024, Transfer Fee has been reduced from 2% to 1% for property with a price that does not exceed THB 3 million.

Download Property Tax

Download Property Tax Info-Graphic

Contact us for a free property tax calculation.